what is the inheritance tax rate in virginia

Another states inheritance tax may apply to you if the person leaving you money lived in a. Virginia does not have an inheritance tax.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

. Price at Jenkins Fenstermaker PLLC by. A strong estate plan starts with life. In fact only seven states access have an inheritance tax.

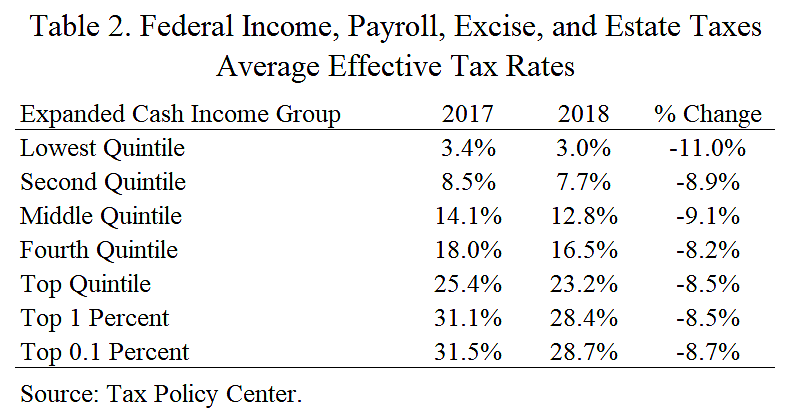

Below are the ranges of inheritance tax rates for each state in 2021 and 2022. What is the difference between an inheritance tax and. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. There is no federal inheritance tax but there is a federal estate tax. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

Virginia does not have an inheritance tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

For example the tax on an estate valued at 15500 is. The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. Virginia Inheritance and Gift Tax. The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Click the nifty map below to find the current rates. The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets.

Note that historical rates and tax laws may differ. Heres a breakdown of each states inheritance tax rate ranges. There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with.

A few states have disclosed exemption limits for. Virginia does not have an inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. The tax rate varies. Gift tax and inheritance tax in West Virginia.

Hawaii and washington state have the. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Virginia Estate Tax Everything You Need To Know Smartasset

I Inherited Land That Recently Sold What Will I Owe In Taxes The Washington Post

State By State Estate And Inheritance Tax Rates Everplans

Virginia Tax Payment Amendments Virginia Business Tax

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Sales Taxes In The United States Wikiwand

Virginia Estate Tax Everything You Need To Know Smartasset

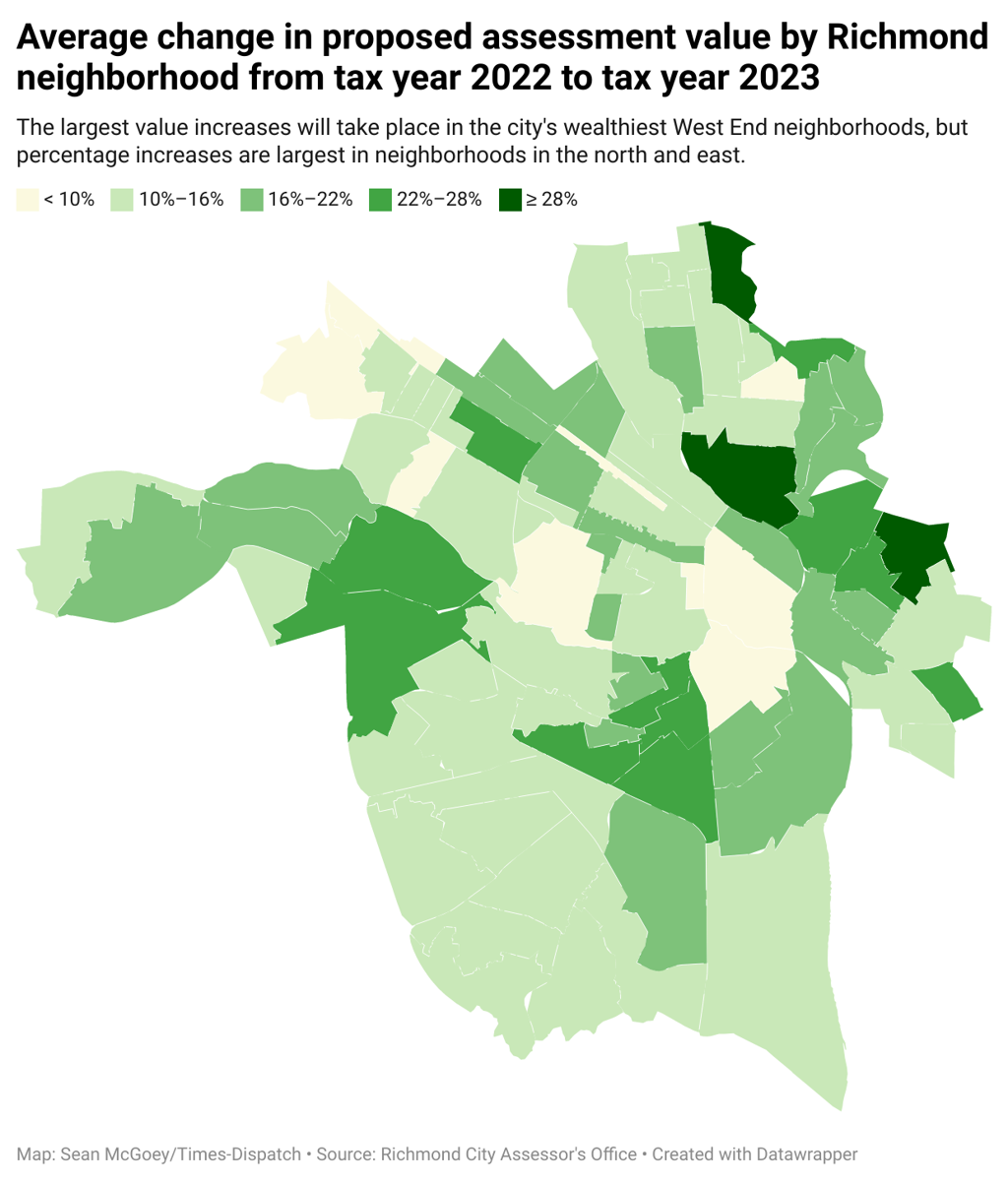

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax